By DJ Summers, Seafoodnews.com [Alaska Journal of Commerce], December 10, 2015 —

A state tax rate glitch let groundfish trawlers off the hook for more than $10 million of fishery taxes in the last half decade, and there’s no concrete fix just yet.

The fishery resource landing tax taxes groundfish based on ex-vessel price. Processors turn flatfish caught as bycatch into low-value fishmeal, so the only known ex-vessel price for certain flatfish species is artificially low. Nine species have this price uncertainty, but most flatfish volume comes from yellowfin sole and Atka mackerel.

By only having an ex-vessel value based on the price paid for bycatch turned into fishmeal, the state has no idea what the ex-vessel value is for the direct flatfish fishery that has annual harvests measured in hundreds of thousands of metric tons.

According to state research estimates, the state has lost out on $1.8 million to $2.5 million per year, or more than $10 million over the last five years. Researchers haven’t yet looked back further due to paucity of data, but the fishery resource landing tax has existed since 1994.

Lori Swanson, assistant executive director of groundfish trawler group Groundfish Forum, did not say whether the industry knew it had been underpaying since the tax’s birth.

“They pay what the state tells them to pay,” she said.

The Department of Revenue, however, hasn’t been calculating a realistic view of fleet’s tax rate, and is only starting to rework the system. The state began this tax specifically for factory trawlers and catcher-processors, but overlooked a systemic flaw from the beginning.

“It’s actually two things,” said Kurt Iverson, a research analyst with the Alaska Department of Fish and Game. “First, a very small amount of the total harvest is in the (Commercial Operator’s Annual Report), and on top of that, that harvest is not representative of a true ex-vessel valuation because it’s coming in as bycatch.”

Anna Kim, the Department of Revenue chief of revenue operations, said she can’t speculate why the issue went for so long without being noticed. Iverson said the problem isn’t intentional. The Department of Revenue simply attached the tax to shoreside sales, which don’t happen for some species.

“There’s nothing wrong, just an artifact of data,” Iverson said. “How do you get at the price when very little ever crosses the dock as a shoreside sale?”

The federally managed Exclusive Economic Zone sits from three to 200 miles off the coast. Groundfish — which includes pollock, Pacific cod and flatfish — makes the bulk of the volume pulled from the federal waters off Alaska’s coast, and is instrumental in making Alaska the most voluminous and valuable fishing region in the nation.

All fish landed at an Alaska port owe some kind of tax, even if caught in federal waters. The fishery resource landing tax retroactively tallies federal fishermen’s haul before it was processed and taxes the unprocessed value, using unprocessed volume and the price at which it sold from fisherman to processor, or ex-vessel price.

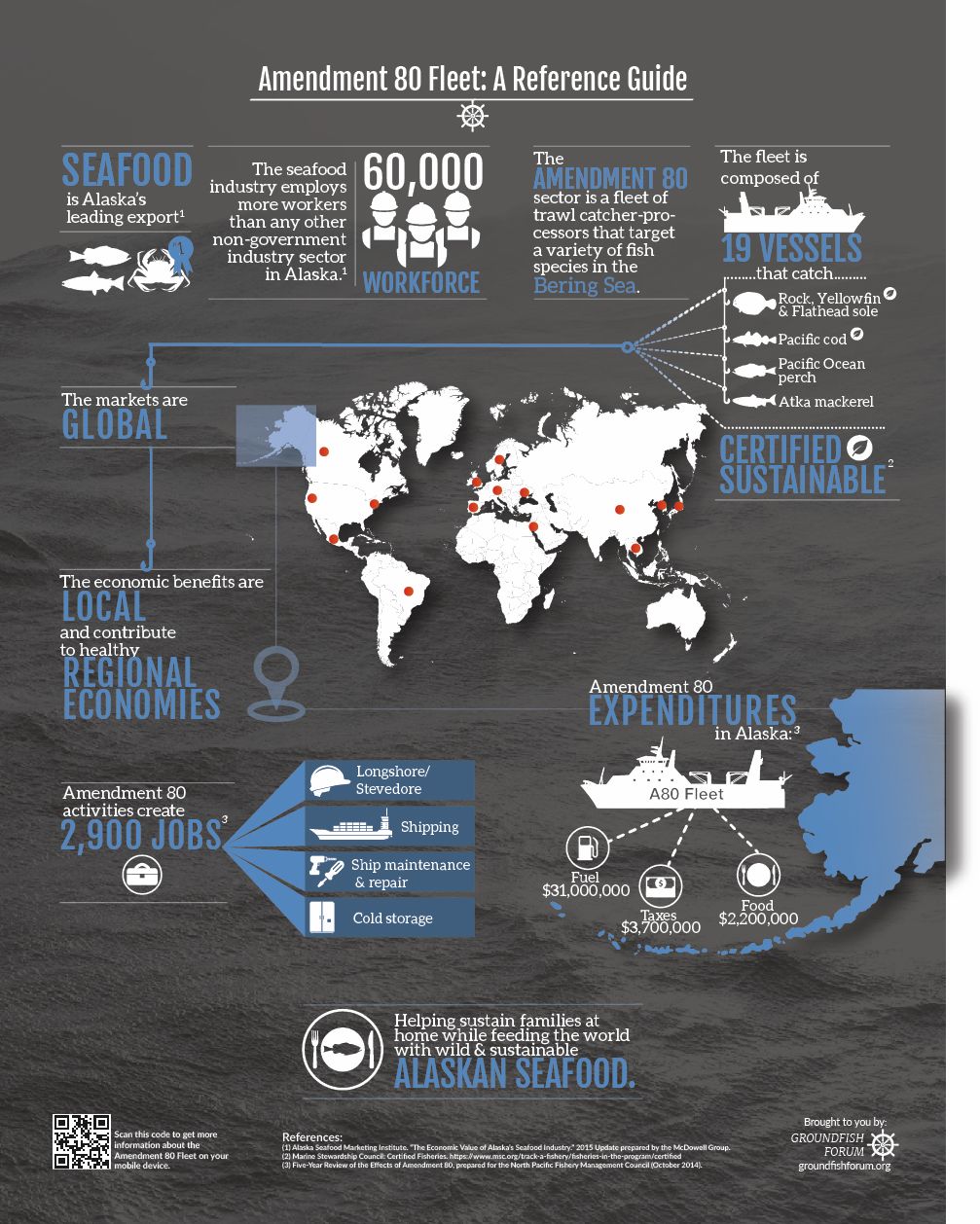

Flatfish are caught in bulk by bottom trawlers, mainly by what’s known as the Amendment 80 fleet based in Seattle (the name derives from the amendment to the Bering Sea Aleutian Islands fishery management plan that rationalized the bottom trawl fleet by assigning harvest quotas).

These trawlers are catcher-processors; they process flatfish right on the boat. Catcher-processor flatfish don’t make the handoff from fisherman to shoreside processor, so the only ex-vessel price is when harvest actually crosses the dock.

Flatfish only make a shoreside sale as bycatch. Trawlers offload loads of pollock or cod and happen to have some yellowfin sole or Atka mackerel in the net. Pollock or cod processors can’t do anything with it besides grind it up for fishmeal, and so they only pay fishmeal prices of just pennies per pound.

Commercial fishermen fill out Commercial Operator’s Annual Reports, or COAR reports, that detail who sold what, and at which price and volume.

According to COAR reports, processors paid an average of two cents per pound for yellowfin sole in 2014, and only a penny per pound in 2013. Atka mackerel must have had more shoreside action to raise its price from fishmeal, but still came in very low at 10 cents per pound in 2014 and two cents per pound in 2013.

At this price, even flatfish caught by the hundreds of thousands of metric tons, doesn’t add up to much in the state coffers.

Alaska fisheries management aims to safeguard coastal communities, and its taxes do too.

“I think (the Commercial Fisheries Division of ADFG) is really concerned about a lot of money leaving the state,” said Kim.

The state enacted the tax in 1993 to be effective the next year. Immediately, the American Factory Trawler Association challenged the tax as unconstitutional. It withdrew the challenge in 1997, and the state declared it constitutional anyway for good measure.

The list of allowable tax credits is coastal Alaska’s wish list; donations for vocational schools and two or four-year colleges, annual intercollegiate sports tournaments, Alaska Native cultural or heritage programs, and in 2011 a very specific allowance for a “facility in the state that qualifies as a coastal ecosystem learning center under the Coastal American Partnership.”

The state splits the income 50-50 with the municipality and borough where the landings occurred. If landed outside a municipality, the Alaska Department of Commerce, Community and Economic Development doles out half the taxes through an allocation program.

Iverson reviewed ex-vessel prices for the past five years and made a range of estimates for how short the state had taxed. He arrived at over $10 million, between $1.8 and $2.5 million per year. Iverson hasn’t yet gone back another 15 years, and isn’t sure the records are around to do so.

With a $3 billion-dollar deficit, $10 million or even a potential $40 million of forgone revenue might seem like short change, but it makes a large percentage of the narrow-based fishery resource landings tax. After credits cut over a million dollar from the total, 2013 and 2014 collected $13.4 and $12.6 million.

The uncollected amount is between 13 percent and 20 percent of the total tax.

The Department of Revenue knows it needs a more complete tax rate, but getting one is laborious.

Kim and Iverson, and their respective departments, are working together to come up with a better metric for flatfish. The priority, she said, is making sure people know the rate’s origin.

“It’s not as simple as just taking whatever the highest (listed ex-vessel) price is,” said Kim. “If we do something outside what we’ve normally done, we need to plainly explain why we chose a certain price.”

Groundfish industry simply wants “a seat at the table” when coming up with a new formula. Swanson said the industry is waiting to provide what information the state needs. She said she doesn’t know how ADFG derives COAR ex-vessel prices, and wouldn’t know how to make a shoreside equivalent in the absence of reliable ex-vessel data.

“There’s just no good way of making a comparable value to shoreside sales,” Swanson said. “I’m sure economists have a way of addressing this, but I’m not an economist.”

The state might normally fill in spotty information with federal research, but in this case the feds are no better off. Federal reports from the National Marine Fisheries Service have had equal trouble nailing down an ex-vessel price for flatfish species, according to Iverson.

“The federal government has struggled with the same problem when it tries to estimate the value of those fish,” said Iverson. “For groundfish, they produce an economic (Stock Assessment and Fisheries Evaluation report), and they gather as much economic information as they can. When they boil it down to the ex-vessel value, they’ve struggled.”

The department could link the value to something other than ex-vessel price, but would have to make regulatory changes to do so. Swanson said linking the fishery value to wholesale price wouldn’t work, either. Between federal reports and COAR reports, ADFG and the Department of Revenue have to find a more realistic price.

In Kim’s eyes, the complexities of fisheries management makes some proposals seem “convoluted,” but Iverson said he’s trying to loop enough extra data into the formula to compensate for COAR ex-vessel prices.

“I proposed giving them not only the COAR, but in addition getting them data from fish tickets, and from the COAR production side,” said Iverson. “I’ll give them data from fish tickets as well. You’d be able to put those numbers side by side and see how much the value was.”

Iverson also said taxes could be derived from processed value, perhaps, or calculated under any one of hundred different ways. With any luck, Iverson hopes 2016 could see a more complete tax plan for trawlers.

“The governor’s budget is coming out soon,” Iverson said. “We’re shooting for that to come up with something.”